As the year wanes and Coloradans are preparing for the Hanukkah, Christmas, New Year’s and other holidays, the day everyone should be dreading is drawing ever nearer: Wednesday, January 8, 2020. That is the day the Colorado General Assembly convenes for its annual 120-day session.

During this time, the progressives who have an iron grip on our state government will be working feverishly, racing against time (and the weather) to further implement their radical policy goals. For a look at what these policy goals are, one need look no further than the 2018 Democratic Party Platform, which I’ve reviewed here. Last year, they got a big start on their agenda, passing the Red Flag law, SB-181 which is crippling energy production in our state, the controversial sex-ed bill and many other terrible laws.

I anticipate fighting battles along several fronts next session. Those include another try at a Family and Medical Leave Insurance Program (FAMLI), a full repeal of the Taxpayer’s Bill of Rights, re-introducing “progressive” (i.e. tiered) income tax rates, and more gun control laws.

FAMLI

Former representative, now state senator Faith Winter has sponsored a FAMLI bill in four legislative sessions so far. The first one, HB 15-1258 was lost on Third Reading in the Democrat controlled House; the second and third bills, HB 17-1307 and HB 18-1001 were both killed in the Senate State Veterans and Military Affairs committee on party line votes. Last year’s bill, SB 19-188 was going to fail as well, but at the last minute the Senate authorized a task force to “study” the program. This is due in no small part to the vigorous opposition of the Colorado business community. Small businesses and large joined together in one voice to oppose this onerous new tax, and activists across the state joined together in opposition to this massive new government entitlement program. I wrote about HB 18-1001 and SB 19-188 as part of that fight.

We don’t know yet what next year’s bill will look like. What we do know is that it will include an illegal income-based tax. I say it’s an illegal tax because even though the sponsors will lie and call the funding source a “premium” (because FAMLI would be a government-run “enterprise”), it is really a “tax” and under our constitution must be voted on by the voters.

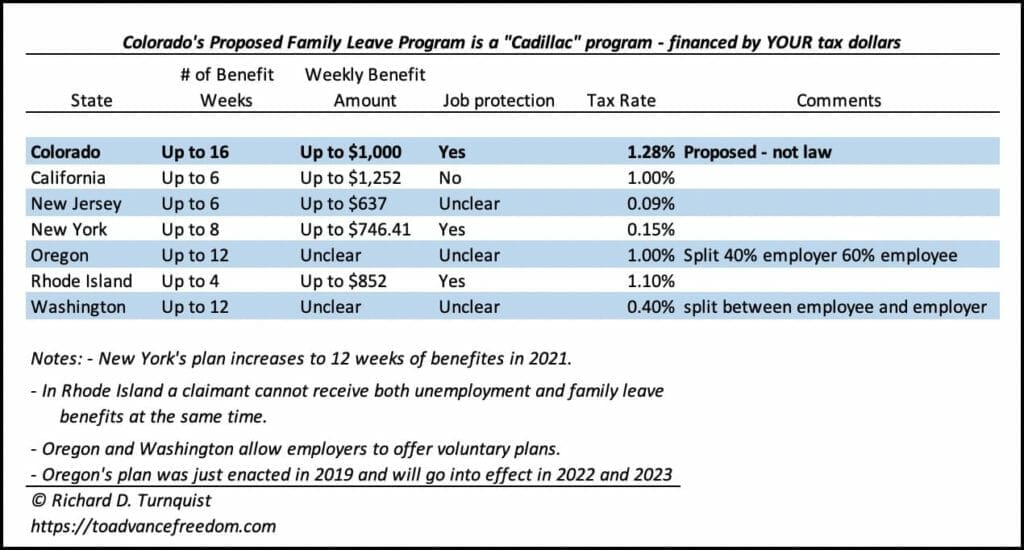

We also know that it will include lavish benefits compared to the handful of other states that offer similar entitlement programs. The table below is based on what SB 19-188 would have created if it had passed.

We know that FAMLI will create another layer of financial and compliance burden on the state’s already beleaguered employers. This video discusses how FAMLI is bad for business and may actually harm women’s chances of getting hired. Finally, we know that the Democrats are desperate to get this program passed. They know that if this tax increase were put on the ballot that it would lose. Let’s fight to make sure they don’t get it passed in 2020.

Repeal of TABOR

Ever since it was voted into the state constitution in 1992, the Left (and some Republicans) have hated the Taxpayer’s Bill of Rights with incandescent hate. Why? Because TABOR puts constitutional limits on how much government can grow. It requires the government to ask permission of the voters to impose new taxes, to raise existing taxes or to issue bonded indebtedness. If the government collects revenues over a certain defined limit, it must refund it to taxpayers unless they ask us to keep it. I’ve written about Why TABOR Matters and how it relates to state budgets.

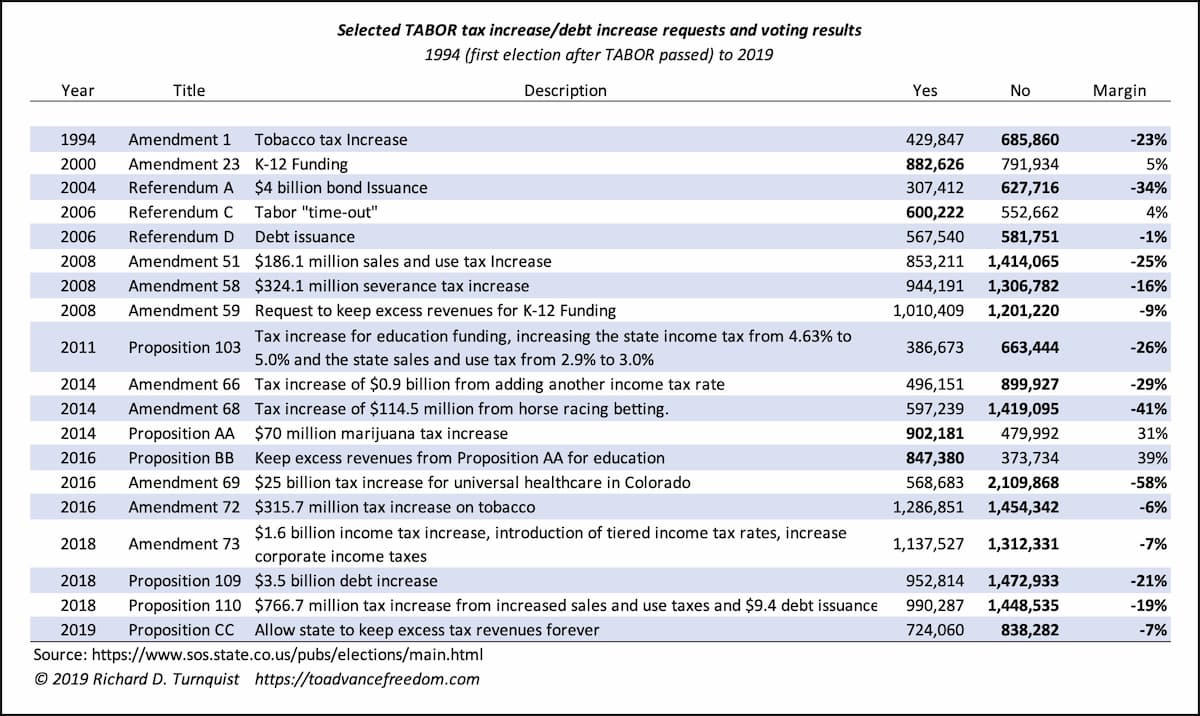

Even though TABOR was weakened significantly by Referendum C in 2005, it has withstood other attacks including the defeat of Proposition CC in the last election which would have eliminated the TABOR refunds of surplus revenues forever. Despite the fact that the proponents spent over $4 million in support, Proposition CC lost big at the ballot box – by 54% to 46%, a pretty handy margin.

This result is not surprising given the results of tax requests in the years since TABOR was passed. With the exceptions of Referendum C, Amendment 23 and two marijuana-related tax requests, Colorado voters have consistently voted “No” on statewide tax increase and new tax requests (which is why I am convinced a FAMLI vote would fail).

Despite this history including the results of Proposition CC, they just can’t let it go. I have evidence that the Colorado Fiscal Institute and the Bell Policy Center (part of The Progressive Infrastructure) are teaming up with other progressive non-profits across the state looking at ballot initiatives to possibly repeal TABOR and/or re-introduce a “tiered” tax rate system in Colorado.

These people from various progressive organizations calling themselves “Vision 2020” are working to bring several policy initiatives to the 2020 ballot. They have kindly posted a recording of one of their policy team meetings on the internet (God knows why), and while it’s two hours long it makes for an interesting listen.

The key takeaways are that a group of 20 or so people met in a conference room to discuss how to repeal TABOR and introduce a “progressive”, i.e. a tiered tax rate system. Their guiding purpose: “A long-term coordinated and inclusive approach to make permanent and substantial change to Colorado’s constitution (Article X, Section 20) that will forever reshape debates on taxes and budgets in Colorado.” (Source: Vision 2020 Slide Deck, August 5, 2019). [Emphasis mine]

The effort to get a TABOR repeal on the ballot is currently pending Supreme Court action, with the last action taking place on August 21, 2019.

Progressive Income Taxes

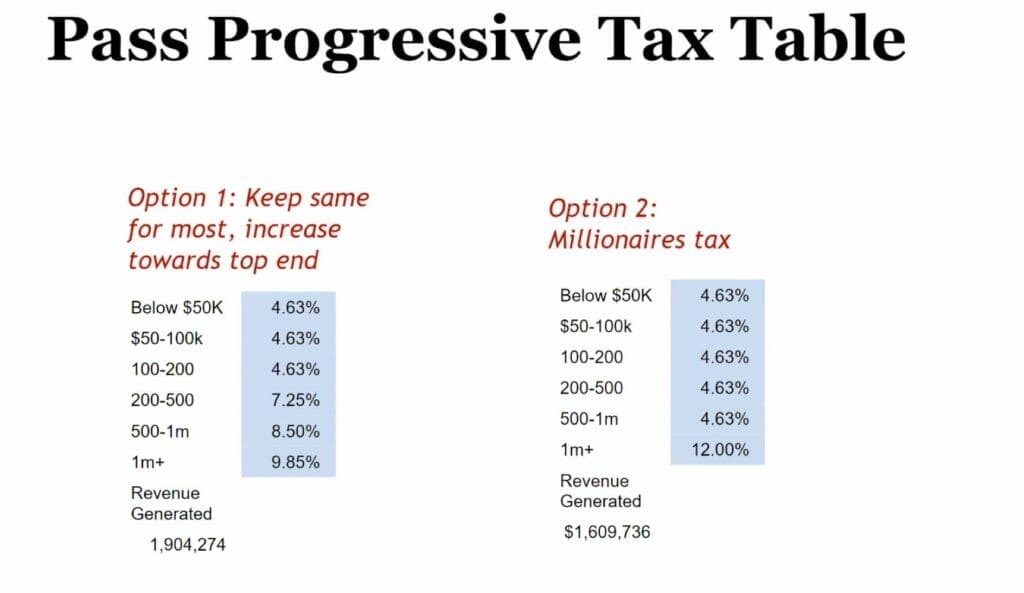

The effort to implement a progressive tax structure is more subtle. Because it is a tax increase, it would have to go onto the ballot as long as the Taxpayer’s Bill of Rights remains in force. During the August 5 meeting, the participants reviewed two possible ideas. One would ask for a revenue increase of up to 1% of state personal income to be allocated to “preschool through high school public education, transportation and higher education” through a tiered tax table that “gradually increases tax rates for higher levels of income, a repeal of the single rate state income tax requirement of the Colorado constitution [TABOR]. The proposal also includes a fail-safe in case the legislature does not create these tax brackets by July 1, 2022: a four tax-rate system and an increase in the corporate income tax rate that would go into effect anyway.

The second proposal contains slightly different language. What is clear is that they seek to punish the more successful through higher tax rates. The slide below shows two alternatives that were discussed at the meeting.

As the table above shows, progressives desire to punish higher income earners with higher tax rates. Option 2 would create an especially punitive “millionaires [sic] tax” that would raise the effective total marginal tax rate for incomes over $1,000,000 to almost 50%, which is neither equitable nor fair.

As we know from An Inquiry Into The Nature and Causes of the Wealth of States: How Taxes, Energy and Worker Freedom Change Everything, states that have higher tax burdens, and that have income taxes, tend to fare poorer economically than states with low to zero income taxes. Colorado’s flat 4.63% income tax rate is more fair and equitable, and contributes to our state’s overall economic success. See my blog Taxation and Wealth for more on this topic.

I encourage everyone to be vigilant to what this Vision 2020 gang is trying to accomplish. Push back, defend TABOR and our fair, flat income tax rate.

Gun Control, Again

We can expect some serious gun control measures to be introduced next session. A recent Denver Post article highlighted how Representative Tom Sullivan (D – Centennial) said regarding gun control “It’s coming. It is. That’s why I’m here”. Despite the fact that violent crimes including murders have risen steadily since the Democrats passed their 2013 gun-control measures, anti-Second Amendment lawmakers are coming back for more.

Some bills I expect to see introduced next session include so-called “safe storage” laws, which would require gun owners to purchase expensive safes to store their firearms, and which possibly could hold gun owners criminally liable for crimes committed with their property; a requirement to report lost or stolen firearms (who wouldn’t want to report such a theft?); a bill prohibiting sales of “repair kits” which can be assembled into standard capacity magazines, and others.

It is not the proper role of government to tell citizens how to manage their property or what crimes they should report to law enforcement. Any gun control laws introduced by Sullivan and his anti-civil liberties cronies should be fiercely opposed. His dislike of guns and gun owners does not give him a moral right to deprive of us our right to keep and bear arms.

An Epic Election

Every four years, when we have a presidential election, people say “This is the most important election of our lifetimes”. While they certainly are all important, this coming election is going to be hugely important in Colorado. This election will be a referendum not just on President Trump, but on the progressives who hate him and have done everything they can to undermine, subvert, sabotage, impair, hinder, impeach and “resist”. Because President Trump has largely governed as a conservative, we have seen record economic growth, historically low unemployment and increasing prosperity across America. We have seen no signs of “fascism” or a desire for totalitarian rule, nobody’s rights taken away, or any of the other dire predictions of a Trump presidency.

In Colorado, we will likely have a full TABOR repeal on the ballot. We will have an initiative to introduce a tiered income tax system. We will have repeal of the National Popular Vote Compact on the ballot. There will likely be a late-term abortion ban on the ballot. There will be others, that will be instrumental in bringing out voters on both sides.

I encourage everyone to study the issues. Study the candidates. Support candidates who will stand for limited government and free people. Reject “progressives”, “moderates” and anyone who promises “free stuff”, because nothing is free, and everything government gives you is taken BY FORCE from someone else at the point of a gun.

Get out and walk for candidates and causes. Make your voice heard on social media. Stand for Freedom. Stand for Colorado.

Responses