Truth and Reconciliation

“A billion here, a billion there, and pretty soon you’re talking real money” – saying attributed to the late Senator Everett Dirksen.

Watching what is happening to the United States under Democrat misgovernance is disturbing – as when rioters are glorified and police vilified; distressing – as when biological males are allowed to compete unfairly in women’s sports; and downright scary – as when the “progressive” socialists running the country propel us headfirst into national bankruptcy.

After the 2020 election the voters in in their infinite wisdom handed complete control of the federal government to the Democratic Party, but their grip on power is tenuous at best. Given the dramatic evidence of Democrat misrule and a deeply unpopular president who is going to lurch from failure to greater failure the Democrats know that the voters will most likely punish them at the polls next year, returning control to the Republicans. Knowing that their grip on total power is limited, they are going for broke – literally.

Against the backdrop of the disastrous withdrawal from Afghanistan and rising inflation in the United States (which erodes the wage gains experienced by lower income workers), the Democrats are trying to ram through a $3.5 TRILLION “reconciliation” bill that will vastly impact the economy and the size and role of the federal government – which has already grown far beyond the limited government with few powers established by the Founders and the U.S. Constitution.

What’s in the big spending bill? A better question is: What isn’t? While the final details have yet to be hammered out, early indications are that it will include bigger transfer payments from some families to other families including:

- A so-called “universal” pre-kindergarten program costing $200 billion. While the average family would supposedly save $13,000 (but remember Obamacare? Who’s saving money under THAT plan?) the states would be required to come up with 50% of the cost when it’s fully implemented. That means unfunded mandates and increased pressure on state budgets. Most likely, states will have to raise taxes (and “fees” and “premiums”) to pay for it.

- Government funded childcare and establishing a minimum wage of $15 per hour for child care workers. (Now they’re talking about raising the minimum wage to $24/hour).

- Two years of tuition-free community college. This would be another unfunded mandate to the states with the federal government paying 75% and the states having to come up with the other 25%.

- Increasing Pell Grants and “investing” in historically black colleges and other institutions that cater to students of color. (No discrimination here!)

- The Democrats want to expand and make permanent the child tax credit. The expanded benefits under the $1.9 trillion coronavirus ‘rescue” plan are only for 2021.

- Expansion of Medicare (already bankrupting the federal and state governments) by adding dental, vision and hearing benefits.

- Extending the “enhanced” Obamacare subsidies passed in the spring of 2021, including handouts to lower income policyholders so they don’t have to pay any premiums.

- “Investing” in home and community-based services to help seniors, the disabled and home care workers.

- A brand NEW federal healthcare program for Americans who live in states that have not expanded Medicaid under Obamacare.

- Making prescription drugs more difficult to obtain by regulating prices.

- Promoting “health equity” and in particular “maternal, behavioral and racial justice health measures”.

- Super importantly, the reconciliation budget buster would combat climate change by making “investments” to reduce carbon emissions by 50% and for the power grid to get 80% of its power from “emissions-free” (hint: all energy sources have some environmental costs) sources by 2030, up from about 11% currently. They want to radically restructure how we generate and use energy in just 9 years.

- And of course, the bill calls for more “investing” in “infrastructure” and “jobs”, including the creation of a youth organization called the “Civilian Climate Corporation” to employ thousands of young people to “work conserving public lands”, “bolstering community resilience” and “advancing environmental justice”. Just what America needs right now! Google “Komsomol” to see where this idea came from.

This $3.5 trillion (that’s $3,500,000,000,000 or $24,255 per 144.3 million taxpayers) progressive fantasy would be funded through one of two ways, taxation or borrowing money, both of which the US Treasury already does. Two trillion dollars of this boondoggle is supposed to be funded by raising taxes.

They also think that they can save $700 billion from prescription drug pricing policy changes (they won’t) and that their gigantic expansion of the federal government will spur economic growth to the tune of $600 billion (it won’t). It’s tragic how politicians, bureaucrats and interested parties are so disconnected from reality, the laws of economics and human nature.

Raising Taxes

For some reason, Democrats think that the earnings and property of productive individuals and successful businesses belong to the government instead of the people who created the wealth.

As former Senator Barbara Mikulski (D – MD) once said: “Let’s go get it from those who’ve got it.”. Democrats really believe that your money would be better used by the government and that it is completely morally acceptable for the government to take your “fair share” from you by force.

The idea of progressive or “tiered” taxation is that those who earn more should pay more, instead of a flat tax where everybody pays the same percentage on all their taxable income.

Under current tax law, a single individual who earns more than $523,601 is taxed at 37%. If that person lives in a high tax state like California, they would be taxed at over 50%. Think about that – over half of what they earn through their productive labor is taken by force from them to fund government programs.

Corporations that pay taxes are taxed at 21%, down from 35% prior to the 2017 Tax Cuts and Jobs Act. Now, corporations pay the taxes, but the money comes from individuals who purchase goods and services from the corporation. All taxes ultimately are paid by productive individuals from wealth that they have generated.

Democrats like to play the class warfare card by emoting that “the rich should pay their fair share”. They speak of “equity” and “justice” when it comes to tax policy, not “fairness”. And really, what’s “fair” is a flat tax where everybody pays the same low percentage.

The Democrats want to raise taxes on the despised “rich” (even though many rich people are leftists for some undiscernible reason) and businesses.

According to the Wall Street Journal, “House Democrats spelled out their proposed tax increases on Monday, pushing higher rates on corporations, investors and high-income business owners as they try to piece together enough votes for legislation to expand the social safety net and combat climate change.”

Their plan would raise the corporate tax rate from 21% to 26.5%. They want to impose a 3% surcharge on people who earn more than $5 million and raise capital gains taxes, which will impact ANYBODY who owns property subject to capital gains, like stocks and mutual funds, which is a large segment of the American middle class.

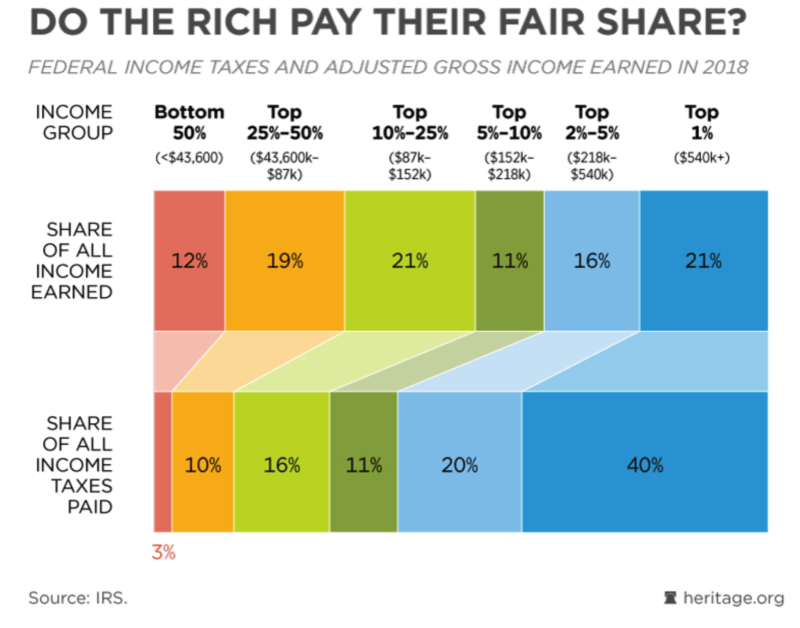

The fact of the matter is, the “rich” already pay 40% of all income taxes in the United States (as of 2018). The top 25% and higher pay 87% of all income taxes. The bottom 50% pay a mere 3% of all income taxes paid. In fact, according to heritage.org, “Over time, high-income Americans have shouldered a larger and larger share of the cost of government. Even the 2017 tax cuts…reduced tax bills for the lowest-income Americans by 10% while only cutting taxes for the top 1% by 0.04%. [Even] after the tax cuts, the rich pay a larger – not smaller – share of income taxes.” [Emphasis mine]

Let’s put this in perspective: in 2020 the federal government spent $6,550,000,000,000. That equates to $17,945,205,480 per day and $45,392 per taxpayer. Even if the federal government were to take the entire fortune of the world’s wealthiest person, Jeff Bezos, it would only fund government spending for about 11 days. And of course, the taking would be a monstrous crime.

No, the well is dry. Increasing taxes would be unfair to everybody and it would cause our economic growth to come to a standstill, generating more misery all the way around. And borrowing the money has costs of its own as well, especially since our global rival China holds a large part of it.

As I’ve written elsewhere, the United States is heading toward sovereign default, or more simply, “bankruptcy”. This $3.5 trillion bill would only bring that day much closer.

One Person

Sometimes momentous policy decisions come down to one person. An example of this is when the late Senator John McCain stood in the way of repealing Obamacare back in 2017, leaving a disastrous program in place and forever tarnishing his legacy. We have a similar situation now, with Senator Joe Manchin (D – WV) as the only bulwark against this disastrous $3.5 trillion bill.

Manchin, a “centrist” Democrat from a solidly red state – West Virginia – has already gone on record in the Wall Street Journal stating that he does not support “…spending another $3.5 Trillion”. In his words: “Many in Washington have convinced themselves we can add trillions of dollars more to our nearly $29 trillion national debt with no repercussions….For those who will dismiss my unwillingness to support a $3.5 trillion bill as political posturing, I hope they heed the powerful words of Admiral Mike Mullen, a former chairman of the Joint Chiefs of Staff, who called debt the biggest threat to national security. His comments echoed the fear and concern I’ve heard from many economic experts I’ve personally met with.” [Emphasis mine]

Let’s hope Senator Manchin stands strong and continues to oppose this bill.

Another Election

Fortunately, unlike the people who live in Cuba or North Korea, we have the ability to change the trajectory of our nation.

Elections are the lifeblood of a constitutional republic and are the civilized way to change a society (as opposed to bombs and bullets, which happens all too often in this world).

A little over a year from now, Americans will head to the polls to vote in perhaps the most momentous mid-term election since the 1990s. It is critical that we boot Democrats from office and install Republicans who we can then hold accountable to our values of limited government and the rule of law.

A Republican majority in the United States Congress would be able to keep the worst of this disastrous president in check. It would give us a level playing field versus the Left. It would delay the looming disaster of bankruptcy.

Elections are so important that there should be audits of electoral practices. There should be integrity to the process. There should be voter ID requirements. Only citizens should have the ability to vote. “Consent of the governed” means that we must be able to trust our elections. When half the country refuses to accept as valid the results of an election, we are in big trouble. And we’ve been in big trouble since 2000 when Al Gore refused to concede the election and forced the Supreme Court to decide between Bush and Gore.

Republicans aren’t perfect. Many of them are “progressives” in their own way, and many of them believe in using the power of government to promote THEIR social agendas. Many have forgotten that the only legitimate functions of government are to protect life, liberty and property. These are the Republicans we must guide, counsel, hold accountable and, when necessary, put up primary opponents.

But many Republicans do believe in our Founding principles. They do believe in a “live and let live” philosophy. They do recognize that government cannot be, is not nor should be the answer to all of our problems. These are the Republicans to donate money to, to volunteer for, to knock doors for, to vote for. Staying home just helps elect Democrats.

In the meantime, contact your member of Congress and your two U.S. Senators to let them know of your opposition to the $3.5 trillion reconciliation bill. Let them know that saddling future generations with this expansion of government is immoral and unacceptable.

Responses

Vote NO!

Let us just hope and pray Senators Manchin and Sinema do not change their minds and cannot be bought to change their minds.