Recently, in Free Market Capitalism vs Socialism, I compared and contrasted the differences in philosophy and outcomes between capitalism and socialism. Capitalism has been proven – in objective, real-world results – to promote human flourishing. In contrast, socialism has been proven – in objective, real-world results – to be disastrous for human flourishing and even fatal for large numbers of people.

This is an important distinction to understand, because one political party – the name starts with “D” – has for the past 100 years or so been sympathetic with the ideas and goals of socialism (before that, they perpetuated and fought a civil war to preserve human slavery), and when people of that party are elected, they work mightily to impose those ideas on us in spite of clear and repeated evidence that their ideas do not work and are, in fact, harmful.

In this essay, we’ll review the roles that government and business play in our economy, how jobs and minimum wages are inter-related and tax policy. We’ll wrap up with a look at how government spending impairs the economy and will ultimately lead to sovereign default. Finally, I will exhort you to recruit, support and vote for principled Republicans next year. Democrats are Exactly Wrong on so many things.

The Role of Government

One of the biggest divisions in our society is over the proper role of government in our lives. We on the Right believe that government should be limited to just those functions necessary to preserve Life, Liberty and property. Those functions include a civil court system to enforce contracts and adjudicate disputes, police power to apprehend criminals, a criminal court system to deal with people who break the law, national defense and border enforcement. Maybe infrastructure – though there is a strong libertarian argument for infrastructure to be privatized.

That’s all.

On the other hand, our friends on the Left believe that government should be involved in EVERYTHING. In their view, government should use force to take money from those who have earned it to give to those who have not. Government should regulate everything, and since we are in a “climate crisis” government should mandate away everything that makes our modern life wonderful: fossil fuels, natural gas ovens, gasoline burning lawn mowers, toilets that actually work, cars that people actually want to drive.

According to them, government should be involved in education from cradle to adulthood. Of course, in most public schools, “education” is actually “indoctrination”. In America today, young people may not know how to read, write or do math, but by God they know which pronouns to use in addressing each other and that America is racist and bad.

The Left wants government to prevent parents from caring for their children who may be confused about certain things in their lives due to social contagions. Then, when those children choose life-altering medical procedures, the Left wants government to pay for it and punish parents by taking their children from them if they try to save them.

In the Left’s view, the government creates economic growth by spending money. They want government to give special rights to their favored groups, which include everybody but heterosexual white men.

In fact, as I wrote in my essay Freedom Isn’t Free, “To the Left, government is mommy and daddy, God, big brother and the Universe all rolled up into a big benevolent teddy bear. Government is your friend and your confessor. Government is what you think of when presented with any of life’s challenges. And because this is a childish worldview, the Left tends to think that their fellow citizens are children too, who need to be managed and controlled by the big government teddy bear. When we resist, they throw temper tantrums and insist that we comply.”

In the 1930s, in response to the Great Depression, the Left grew the size of the federal government dramatically. President Franklin Roosevelt (D) created several “alphabet soup” agencies to expand the role of government in the economy, many of them deemed unconstitutional. The biggest disaster of the 1930’s, economically speaking, was the passage of the Social Security Act in 1935. With the stroke of FDR’s pen, the federal government took on the responsibility of creating, managing and disbursing retirement savings for millions of Americans over multiple generations.

The initial payroll deductions for social security were quite minimal, but over time they’ve grown to 6.2% of earnings up to a ceiling of $160,200. (Once you hit the ceiling in a year, no more SS deductions! It’s like a raise. Too bad it only lasts until the end of the current year.)

Social Security was pitched as a kind of savings account – workers put their money into the “Social Security Trust Fund”, and then when they retire, they are supposed to get that money back. But the money, over time, accumulates at only what is put in, unlike investments which earn interest and dividends, plus market growth.

Over the years, however, the federal government under both parties has raided the mythical Social Security Trust Fund so many times that it’s only assets now are a bunch of IOUs from the US Treasury. No, in what can only be considered a massive Ponzi scheme, the government takes money from workers today to pay the benefits of people who have already retired. As the number of retirees grows while the number of workers shrinks, the more needs to be taken from them to fund the current retirement burden. When crooks perpetrate Ponzi schemes, they are prosecuted by the Securities and Exchange Commission, but the biggest Ponzi operator of all is the United States Treasury.

The Role of Business

A ‘business” exists for one reason and one reason only: to make money for its owners. Along the way, it can provide other benefits: jobs for employees, products and services that customers want, tax revenues for the governments. To the extent that a business earns more than its expenses, it is earning a “profit”. It is creating wealth for its owners and for the people who purchase goods and services from it.

Only individuals and, in the aggregate, businesses can create wealth. The amount of wealth that a business creates is a function of several interrelated things: the demand for its products and services, the efficiency with which it produces those products and services, the costs of the inputs, and others.

While running a small “mom and pop” shop can be relatively simple, running a large commercial enterprise is anything but. The combined revenues of the Fortune 500 companies in the 2022 fiscal year was $18 trillion. These companies employ hundreds of thousands of people, use trillions of dollars in inputs, and have several highly complex functions that have to be overseen: finance, accounting, information technology, human resources, supply chain management, marketing, regulatory and government as well as stakeholder relations. And that is just the beginning. The large commercial enterprise also has to have expertise in the products and services it offers to the public. The number of people with the skills and experience to manage such large businesses is very small and given the value they create and the value creation they oversee, it is no wonder that they are highly paid individuals.

As a side note: most executive-level people receive a base salary. Some seem quite high, others are not. Lee Iacocca famously took only $1 in salary when he was trying to revive Chrysler back in the 1980s. The bulk of executive compensation comes in various forms of equity and performance-based compensation. This means that this money is not earned unless the company’s stock price performs well, and the performance-based piece means that they have to meet certain performance targets as well.

When you think about the knowledge, skills and experience necessary to successfully lead a large publicly owned company; the value creation they oversee, their pay doesn’t seem so outlandish after all. At the end of they day, they are paid what their contributions are worth, not a penny more. If they fail to earn their keep, they’re out, and quite publicly, too.

The bottom line is: businesses create all of the products and services we enjoy and the wealth that exists in our world. Business is literally the lifeblood of our economy.

Jobs and Minimum Wages

When a business (or a non-profit entity or a government) has something that needs to be done, they hire a person to do it. After a negotiation that is mutually acceptable (maybe not everything either party wants), a person goes to work for a company. (I’m only going to talk about profit-making enterprises here.)

In exchange for providing labor or some other service, the company pays a wage (hourly) or a salary (“exempt”). The employer is not doing this out of the kindness of their heart, they are doing it because they need something done, whether that’s making a sandwich for a customer or designing a microchip.

In the absence of any laws or regulations, a company is going to pay a person what they think the value or service provided by that person is worth. Likewise, the person providing the labor or service isn’t going to work for less than they think their contribution is valued unless they choose to – as in when they just need the money. Now, I know that circumstances often dictate otherwise – companies may pay more or a person may accept less (or vice versa), but in the absence of other factors over time the principle I noted still holds true.

Sometimes government rules dictate that a business has to pay workers a certain amount of money per hour regardless of whether they are gaining that value from that worker or not. These rules are known as “minimum wage laws” and they make it illegal to hire people who are just starting out on their lifelong journey of gainful employment.

Thanks to minimum wage laws, a young person who doesn’t have many (or any) marketable skills will find it difficult to get that entry level job where they learn vital life skills like showing up to work on time, performing well, earning promotions and paying their own way. So-called “minimum-wage jobs” aren’t supposed to be the way that the primary breadwinner of a family earns their living, they are so young people can learn to work. If government rules make it too expensive to hire entry level workers, those jobs will go unfilled or be replaced by automation. End result: entry level job seekers – usually young people and people of color – will find it hard to find that first job. When that happens, they turn to others – including the government – for support. Which is exactly what the Democrats want. They want a bunch of helpless dependents instead of strong, self-sufficient people.

“Taxation is Theft”

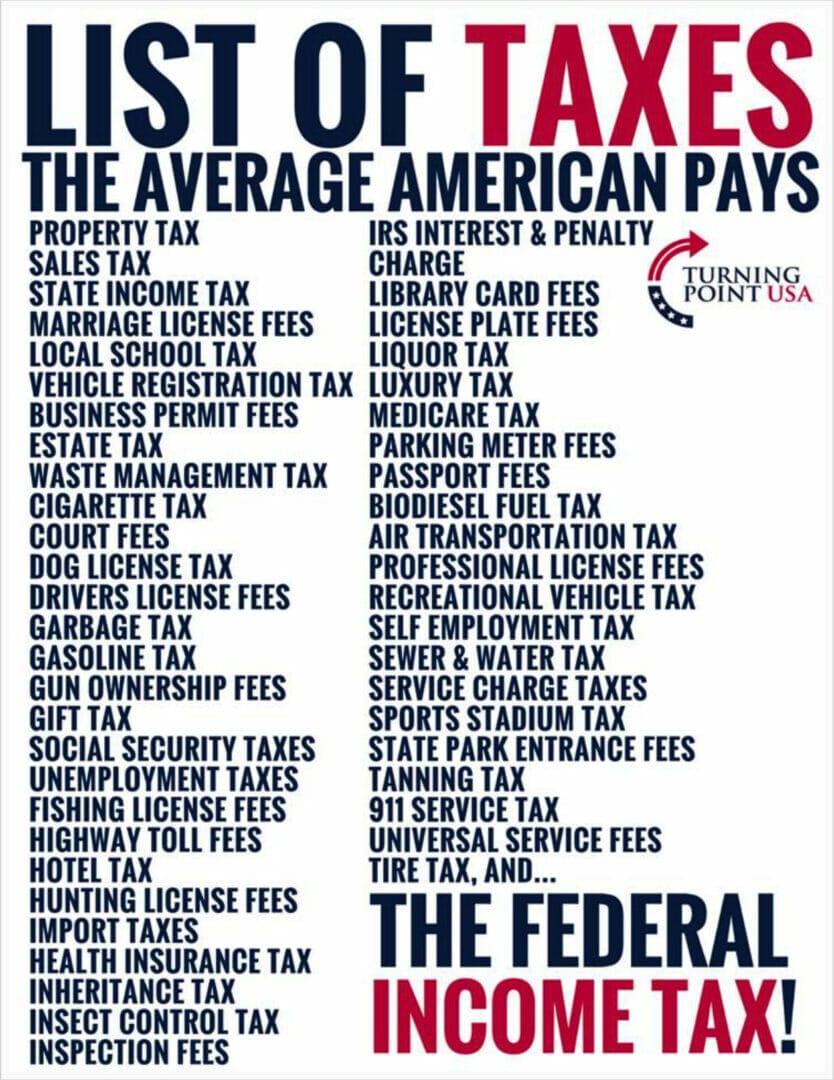

Benjamin Franklin once said “…nothing is certain except death and taxes”. Taxes – which represents money taken from people by government force – are how government operations and programs are funded. Taxes have been with us since the dawn of civilization and will be with us long after we’re gone. Levying and collecting taxes is the primary function of government in many people’s eyes, and the more the better! We are taxed on so many things, and we are often double- or triple-taxed on the same things. Below is a list of taxes and fees the average American adult pays:

This list omits the FAMLI “premiums” that drove me out of Colorado, but otherwise it looks pretty comprehensive. Now, some of these taxes go to fund legitimate government programs like courts, law enforcement, defense and mail delivery. The rest go to fund unconstitutional, unnecessary and wasteful government spending and even worse: transfer payments. Transfer payments are when government takes money from the productive people who earned it to give to someone else who did not earn it. It was when I learned how much of the federal budget consisted of transfer payments in the early 1980s that I became a lifelong conservative. It’s truly mind-blowing.

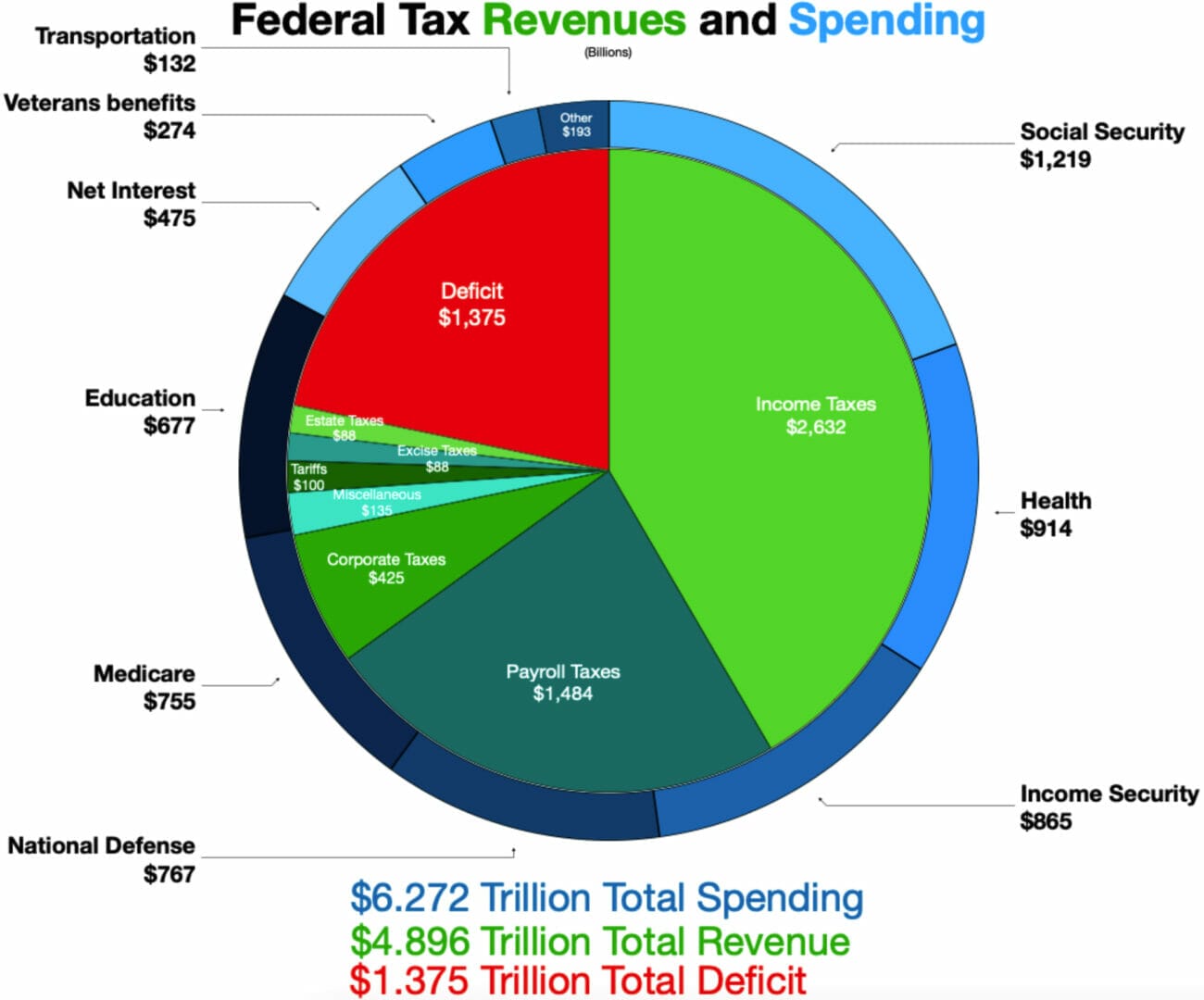

The chart below shows the “revenues” and the spending of the US government in the most recent fiscal year.

A note on reading this graphic: the “pie” part of the chart is “Revenues”. The ring around the pie is spending. The “Payroll Taxes” of $1.5 trillion largely covers the “Social Security” spending item of $1.2 trillion. But “Income Security” represents nothing other than transfer payments. The only legitimate functions of government – transportation (maybe), veterans benefits and national defense, only account for $1.2 trillion of the spending.

To the extent that taxes exceed the legitimate functions of government, it is fair to say that that money has been stolen from taxpayers by the only entity with the legal monopoly on the use of force – hence, taxation is indeed theft.

When a person is working for someone else, at their behest and without the ability to keep what they produce, they are a slave. When someone is working and the government takes more than 50% of their income in the form of taxes (which does happen to higher-earning people), at what point does their “fair share” turn into de facto slavery? 60%? 75%? 90%?

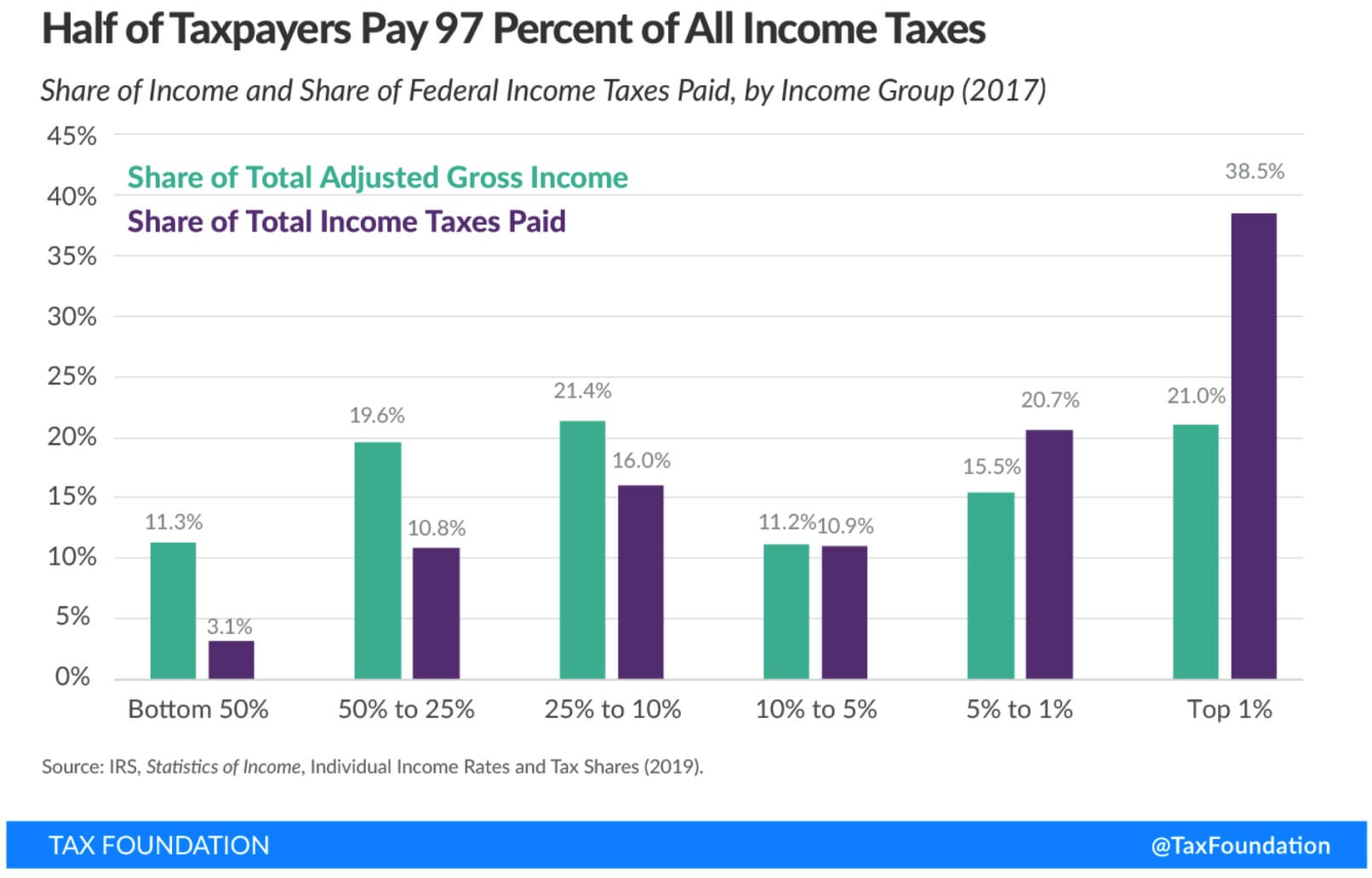

Finally, speaking of “fair share”, our friends on the Left are always clamoring for “the rich” to pay their “fair share”. Well, they do, and then some. As the graph below shows, those in the top 10% pay 70% of all income taxes, while they earn only 48% of adjusted gross income. Those in the bottom 50% only pay 3% of all income taxes and have 11% of adjusted gross income. Quite simply: higher earning people pay more than their fair share and to say that they do not is a lie.

Spending and Bankruptcy

Individuals and families have two ways of obtaining the money they need to live in today’s world: via productive labor, in the form of wages or business earnings, or through “unearned income”- gifts, inheritances, money received from government, charitable receipts, etc. For the purpose of this discussion we will only focus on “earned income”.

If a person spends more than they earn, they have to fund that spending by borrowing money, which is why credit card and other forms of debt are so prevalent. When a person’s debt load gets to be too big, and they cannot afford the interest and payments on that debt, they are “bankrupt”.

The same principle applies to governments, except for one big thing. Unlike an individual, who cannot print money, governments can and do. They can also borrow money, which they do. The amount of our national debt now exceeds the value of our entire economy. Unless things change drastically, the United States will declare sovereign default one of these days. The periodic debt ceiling fights and the recent downgrades of US debt are symptoms of this fatal disease.

All of this spending is bad for the economy, because in aggregate, dollars spent by the government are not saved or invested in new productive capacity, products or services.

The only party that even thinks about cutting spending is the Republican party. The Democrats, on the other hand, want to increase it without any limitations. They want everyone dependent on government handouts so that those people will continue to vote for Democrats and keep them in power. We don’t have a revenue problem. We have a spending problem.

Conclusion

The primary driving force behind all of these destructive economic policies is the “progressive” ideology which grew out of the aftermath of the Civil War enacted by decades of legislation primarily sponsored by the Democrat Party. Democrats glorify government and hate business. They promote socialism and work to destroy capitalism. They foster government dependence and abhor self-sufficiency and rugged individualism. They promote a culture of victimhood. They claim to value science but deny it in relation to human biology and climate. They hate our modern life and work tirelessly to tear it all down.

Democrats are exactly wrong on so many things – economics being one of them. I cannot stress strongly enough how important the election next year is going to be, and I cannot stress strongly enough that no matter how you may feel about the candidate with the (R) next to their name, you should vote for them. They may not be perfect, but the other side is clearly unfit to govern.

Responses